We all know insurance provides important financial protection if you get sick or injured. But did you know the type of work you do determines how much you pay for your death, total and permanent disablement (TPD) and income protection cover?

That’s why it’s important to make sure you’re in the right occupation rating for your job.

What’s an occupation rating?

Our members come from all professions. From teachers, bus drivers and small business owners to dentists, hairdressers, car dealers, public servants and retail workers.

Naturally, each job comes with different amounts of risk in terms of injury and sickness.

For example, a mechanic is more likely to be injured at work than a public servant, and a builder is more likely to be exposed to hazardous materials on a worksite than a CEO would in a boardroom.

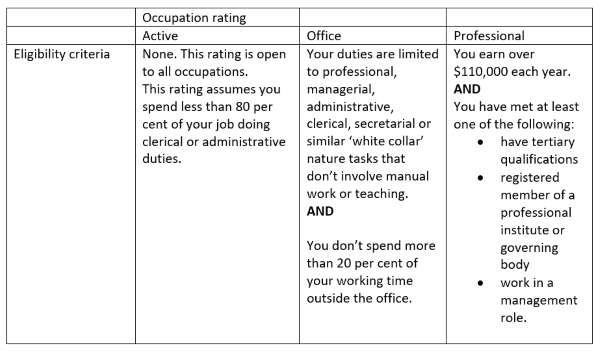

To account for this risk variation, we offer three occupation ratings: Active, Office and Professional. Each rating reflects different jobs and workplaces you — our members – work in.

Which occupation rating you’re in affects how much you pay for your cover. Generally, the ‘riskier’ your job or workplace, the more you pay.

Here’s a breakdown of our ratings:

Active (default)

All members start in the Active rating. It covers everyone but is designed specifically for workers in non-office environments and manual roles. This includes teachers, nurses, mechanics, builders, labourers and tradespeople. Workers in this category pay the most for cover as they tend to work in ‘riskier’ jobs and workplaces.

Office

This rating covers workers who spend at least 80% of their working time in an office environment. It includes public servants, administrators and secretaries. Workers in this category pay less for cover than those in the Active category. However, you must apply and be accepted to switch to this rating.

Professional

This rating is for white-collar professionals who earn over $110,000 each year and have tertiary qualifications, work in a management role or are registered with a professional institute or governing body in relation to their profession. This includes workers such as lawyers, doctors, managers, CEOs and academics. Given the relatively minimal risk of work-related sickness and injury in these professions, they pay the least amount for their cover. Like the Office rating, you must apply and be accepted to switch to this rating.

What’s my occupation rating?

By default, all Spirit Super members start in the Active category. So, if you’ve never applied to switch ratings, you’ll also be in the Active category. That said, you don’t have to assume. You can find out exactly what occupation rating you’re in under the Insurance tab in Member Online.

To find out, log in now.

Can I change my occupation rating?

Being in the right occupation category means you’re getting the best value for your cover.

So, just like you can apply to change the amount or type of cover you have, you can also apply to change your occupation rating to better reflect your specific situation.

For example, 28-year-old administrator Jen is in the default A Active occupation rating. She pays $214.07 each year for default death and TPD over.

However, as an office worker who performs little to no manual duties, she could apply for the Office occupation rating. If accepted, her cover costs would drop to $149.54 each year.

That’s a saving of $64.53 each year to help her super grow1.

You can apply to change your occupation rating anytime through Member Online or by submitting an Occupation rating form.

Just keep in mind you need to meet the relevant eligibility requirements. These are listed in the table below and can also be found in the Insurance guide.

Need help?

Not sure if you’re in the right occupation category? No problem, our Superannuation Advisers can help. Call 1800 005 166 to book a one-on-one chat. Advice is offered at no additional cost. It’s all part of the Spirit Super experience.

Words: Shamin Haky.