Motor Vehicle Duty and other state tax relief for Bushfire Victims

Members are advised of a Victorian Government's announcement relating to a range of tax relief measures for people and businesses affected by the Victorian bushfires. VACC applauds the Andrews Government on this initiative.

These measures include:

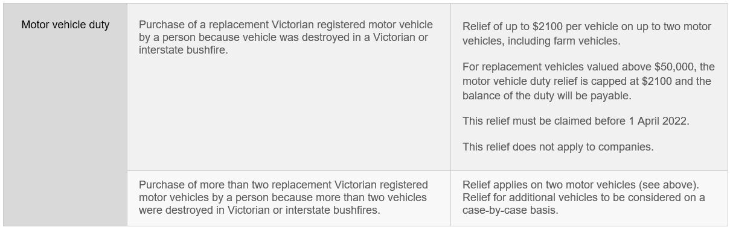

- Motor vehicle duty relief for people who need to replace vehicles destroyed by bushfires.

- Land tax relief on properties that have been affected by bushfires or are used to provide free accommodation for people displaced by bushfires.

- Land transfer duty (stamp duty) relief for people who need to replace homes destroyed by bushfires.

- Reduced land transfer duty (stamp duty) on purchases of commercial or industrial property in bushfire affected local government areas.

- Reduced payroll tax for regional employers with a registered address in a bushfire affected local government area.

It is important to note that Land Tax assessments have been placed on hold for people who live or own land in affected postcodes and that the Victorian Government has announced a range of tax relief measures. The Victorian Government have also put land tax assessments on hold for people who live or own land in bushfire affected areas.

Information regarding Motor Vehicle Duty relief for consumers who need to replace vehicles destroyed by bushfires:

VACC will look to VicRoads and the Victorian State Revenue Office (SRO) to provide advice on how those exemptions and criteria must be applied at the dealership level. VACC will advise once that information is publicly available.

For further information take this link to the SRO website or call the SRO on 13 21 61.

You are encouraged to refer any issue regarding Motor Vehicle Duty to your own tax advisors.