Industry insights

26 April 2022

Despite the phasing out of COVID related restrictions in the economy, the impacts of the pandemic are still very real for many automotive businesses, whether it be supply constraints, cost increases, skilled labour shortages or other ongoing pressures.

The good news, however, is that the automotive industry has continued to expand during the COVID period, and this growth is reflected across almost every sector of the industry.

The latest business data from the Australian Bureau of Statistics (ABS), shows that in aggregate there were 74,775 automotive businesses actively operating in the economy as at 30 June 2021, up by 2,487 businesses or 3.4 per cent over June 2020. This growth is above expectations, and largely reflects the success of business support measures implemented by the Federal Government, such as the JobKeeper program, the Boosting Apprenticeship Commencements wage subsidy program and other initiatives which helped support automotive and many other industries over the period.

There were only three automotive sectors that lost businesses during 2020/21, and these were:

- Motorcycle retailing – down 10 businesses or 1.6 per cent (from 635 to 625 businesses)

- Tyre retailing – down 29 businesses or 1.4 per cent (from 2,117 to 2,088)

- Commercial vehicle wholesaling – down 4 businesses or 1.5 per cent (from 270 to 266).

All remaining automotive sectors grew their business populations, with the top five growth sectors consisting of the following:

- Motor vehicle dismantling and recycling – up 155 businesses or 11.4 per cent (from 1,358 to 1,513)

- Automotive electrical component manufacturing – up 39 businesses or 9 per cent (from 431 to 470)

- Other motor vehicle parts manufacturing - up 55 businesses or 5.6 per cent (from 975 to 1,030)

- Automotive repair and maintenance – up 1,198 businesses or 4.8 per cent (from 24,770 to 25,968)

- Automotive body, paint, and interior repair – up 579 businesses or 4.7 per cent (from 12, 425 to 13,004).

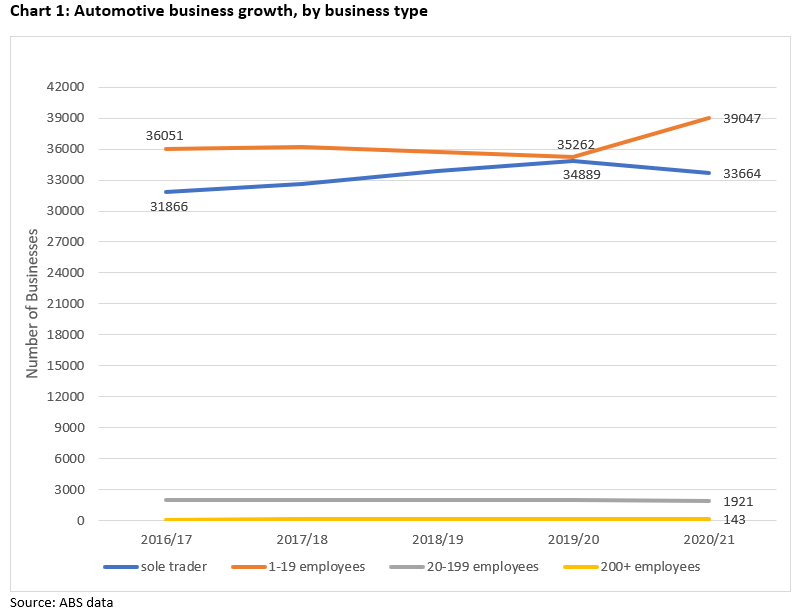

A deeper analysis of the data reveals some further insights. Over the past four years, the automotive industry has been characterised by two distinct trends – a slow decline in the largest industry segment, which is small businesses containing between 1 to 19 employees, and secondly a rapid growth in the number of sole trader businesses with no employees. These trends are displayed in Chart 1.

Chart 1 shows that if it wasn’t for the emergence of the pandemic in 2019/20, the number of sole trader businesses with no employees would more than likely have surpassed the number of small businesses containing one to 19 employees, and therefore become the largest business cohort within the automotive industry. This would have been an unprecedented development for the industry.

Instead, the data reveals a distinct reversal of these trends from 2019/20 onwards, where the number of sole trader businesses fell by 1,225 businesses, while the number of small businesses containing one to 19 employees rose strongly by 3,785 businesses during 2020/21. Furthermore, these trends are consistent across almost every automotive sector.

There are numerous reasons that can help explain this phenomenon, but the pandemic remains at the core. It is hard enough to start a new business at the best of times, but for many marginal sole trader businesses, the lockdowns and trading restrictions imposed during pandemic may have been the final straw. There is also evidence that the eligibility criteria or process for gaining access to JobKeeper and other business support payments was more difficult for sole traders compared to businesses with employees, and this may also have been a factor in the demise of some sole traders.

Retirements may also play a strong part in explaining the data. Typically, between five to 10 per cent of the industry business churn in any given year is due to retirements, and for some operators a decision to retire from business may have been hastened by the onset of the pandemic, particularly in the light of difficulties experienced in obtaining stock, raw materials, and other items.

Before the onset of the pandemic, there was evidence that many experienced automotive technicians were increasingly leaving their employers to start up their own service and repair businesses, and this was key factor in the strong growth trend in sole traders leading up to 2019/20. Given the acute industry labour shortages and the attraction of higher wages being offered by many employers, it is possible that many new business starters were lured back or poached by established businesses during the pandemic. Furthermore, there is evidence of ongoing industry business consolidation occurring throughout the COVID period, which may also account for the trends displayed in the data.

The next business snapshot for 2021/22, due in August this year, will help answer some of these questions and ascertain whether the reversal in the growth trends between sole traders and small employing businesses is simply an aberration due to the pandemic, or is sustained beyond the pandemic.

Words: VACC Senior Research Analyst, Steve Bletsos.

1178